Chargeback Resolution Management

Primax’s Chargeback Resolution Management Initiative Rollout Delivering a streamlined process, real-time visibility and enhanced cardholder experience

Financial institutions face many challenges in trying to deliver a seamless disputes management process. In the wake of growing disputes volumes and heightened cardholder expectations, Primax has made a multimillion-dollar investment in disputes management. We have collaborated with market-leading technology organizations to significantly improve the process to report and resolve a dispute for both financial institutions and cardholders.

Last year, we announced our goal to deliver this new optimized process in phases and, as promised, the first two phases are now live. These phases of the new dispute management experience will allow financial institutions on the Optis platform to process credit fraud and non-fraud disputes using the brand-new technology!

As we continue to roll out phases and enhancements in the coming months, we will continue to provide updates. Please visit this site often for new information on this initiative.

A Closer Look at Primax’s New Disputes Management These features fully optimize disputes management, utilizing robust technology and process automation

Key Features of the new disputes management solution include:

Upcoming Phases

Optis Credit

Non-fraud disputes & General

Correspondence – Live today

Optis Credit

Fraud Disputes – Live today

Optis Debit/In-house Credit

Non-fraud disputes

Optis Debit/In-house Credit

Fraud disputes

Northeast Debit

Non-fraud disputes

Northeast Debit

Fraud disputes

Future phases will include the additional functionality:

Digital Delivery of Disputes

Updates (SMS/Email)

Case Tracking Experiences

(DX Solutions/APIs)

Additional Information will be

provided as available

Frequently Asked Questions (FAQs)

What will the key benefits be for my financial institution and cardholders once this new process is implemented?

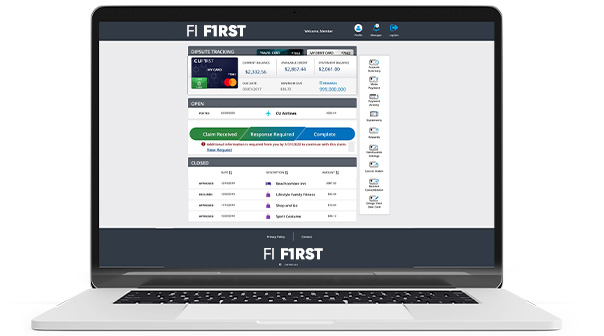

Primax’s new disputes management solution will positively affect both our financial institutions and cardholders, creating an efficient, transparent cardholder experience. When fully complete, dispute case status will be immediately available to both your financial institution and the cardholder via the cardholder’s preferred channel, including real-time integration with association platforms.

For your financial institution, the optimized disputes process will provide a consolidated dispute/fraud platform for both credit and debit disputes, centralized case status reporting through the Disputes Portal and strategic regulatory communication through Cardholder Insight.

For your cardholders, the new process will provide real-time visibility into case status, improve speed of case resolution and provide cardholders a choice of channels for interactions around their case.

Is there a cost for this initiative that will affect my financial institution?

No. The cost for this initiative is included in Primax’s multi-year investment in technology to further advance its industry-leading solutions.

Will there be any pricing changes for the new disputes process?

There are no pricing changes involved at this time.

What are the key timeframes for general availability of the new disputes management solution?

For a full project timeline, contact your Primax Account Executive. Key phases to rollout include:

- Phase 1: Optis Credit – Non-fraud disputes – Live May 24, 2022

- Phase 2: Optis Credit – Fraud disputes – February 28, 2023

- Phase 3: Optis Debit/In-house Credit – Non-fraud disputes

- Phase 4: Optis Debit/In-house Credit – Fraud disputes

- Phase 5: Northeast Debit – Non-fraud disputes

- Phase 6: Northeast Debit – Fraud disputes

Can my financial institution volunteer to be a pilot bank?

Not at this time. Participants in the pilot program have already been identified via Primax’s Account Management teams.

Questions?

Please submit the form below and a team member will reach out.