It’s in your phone, your desktop and your car. It helps your robot vacuum navigate the room and may even assist your healthcare provider in creating a treatment plan. And it’s all over the financial world, offering advice on wealth management and stock market trades, automatically funneling calls through the contact center, and keeping your money safe by fighting the war on fraud.

We’re talking, of course, about artificial intelligence, or AI, which has undergone rapid and transformative advancement in recent years. Every day, AI models demonstrably improve on challenging tasks like image recognition, question answering and coding – and we’ve seen explosive growth in investment and usage, fueling innovation and further expansion into virtually every business sector.

AI is reshaping the way we live, work and interact with the world around us – and it didn’t just start with the recent emergence of ChatGPT. Below is a snapshot of AI’s history, the state of AI today and why we’re focusing on it now, as well as some thoughts about moving forward.

What It Is and How It Got Here

Artificial intelligence can mimic human intelligence for completing tasks and making predictions. The two general categories are Generative AI (GenAI), which learns from existing data content to create new, original content based on prompts (images, video, music, etc.); and Agentic AI, which moves beyond generation into actions. AI agents can be automated (autonomous), assisted (human-in-the-loop requirement) or passive (requiring humans to take the action). The most common form of AI used today in organizations is GenAI, but both are now deeply integrated into modern tools.

AI first emerged in the 1940s, starting with Natural Language Processing (NLP), which focused on the interaction between computers and human language. Examples of NLP that we still see today are voice-to-text applications, such as closed captioning and movie subtitles.

In the 1950s, we saw the emergence of Machine Learning (ML), which involves training algorithms to make predictions or decisions without being explicitly programmed. Machine learning is used in fraud detection (rule writing), streaming services and other purchase recommendations, and spam filters, among common applications.

Computer Vision came into being in the 1960s, with AI that enables computers to interpret and understand visual data from the world. This technology has led to facial recognition and camera systems for self-driving cars.

In the 2000s, repetitive tasks became automated with Robotic Process Automation (RPA), freeing up humans for activities that require judgment and reason. We use RPA for things like automated data entry and invoice processing.

Why Is All the Focus on AI Now?

Starting in about 2022, we’ve been building on prior AI technology for astounding breakthroughs in NLP, with large language models and deep learning powering near-instant results in both GenAI and Agentic AI. We’ve made substantial progress in a very short period of time – but every day, the generative aspect of AI is supercharging development. Machines are now able to generate their own programs and computations for machine learning to get to the outputs, whereas in the past, these were guided. Three concurrent advancements are contributing to this:

- Computing power, which has grown exponentially thanks to advancements in chip design, materials and architectural innovations like parallel processing and specialized hardware like GPUs and TPUs

- Substantial data that is not just large in quantity but also high in quality and diversity

- Algorithmic improvements that allow us to train bigger and more capable AI models using less computation

AI advancements have created massive growth capabilities among fintechs and financial institutions, supporting customer service, fraud detection, personalization and automation.

- In the contact center, conversational chatbots help route calls to the correct agent; mid-interaction, AI can read emotion, understand intent and interpret verbal cues to provide resources for the agent to further assist the customer.

- For data security, AI helps identify signs of fraud hidden within millions of routine transactions; AI voice biometrics can confirm a caller’s identity with only a few spoken words.

- AI can analyze vast amounts of user data to understand customer preferences, allowing marketing efforts and user experiences to be tailored to each individual.

- Complex, tedious tasks can be handled by AI, which can learn and adapt to changing conditions.

Moving Forward with AI

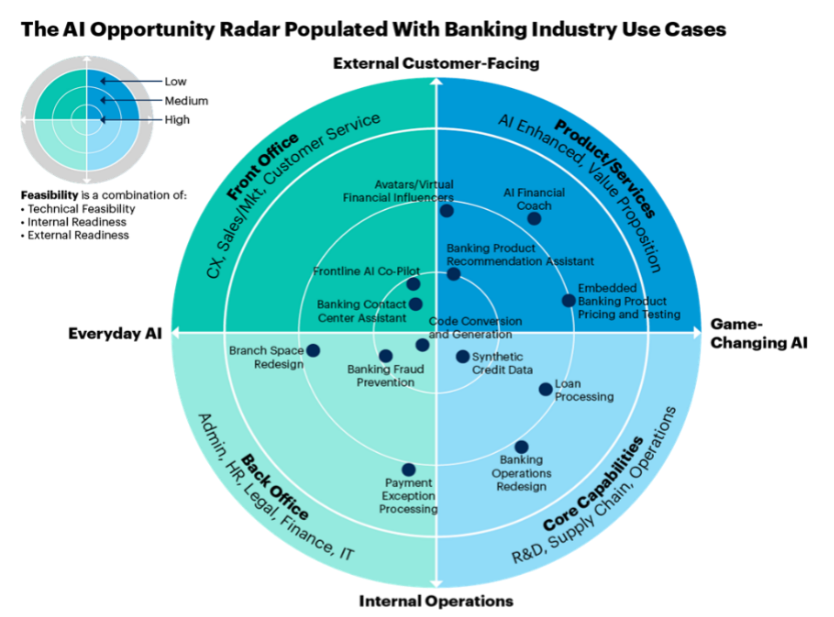

The operational efficiency made possible by AI is no longer a nice-to-have option; it’s a competitive necessity – and the latest AI advancements continue to raise expectations in every sector. For financial institutions, these efficiencies require more than adopting AI – you’ll need to rethink entire processes, staffing, training and more. AI goals and adoption should be strategic, responsible and impactful – not reactionary – and aim at increasing revenue, reducing or avoiding costs, mitigating risk, gaining efficiencies, boosting service quality and improving time to results. Managing risk, harm and bias requires strong governance with diverse perspectives.

It’s a lot to take in, but we’re only just scratching the surface. In future posts, we’ll explore the importance of governance and concerns about security, privacy and intellectual property as they relate to the adoption of AI. For now, I encourage financial institution leaders to stay informed about AI, consult with fintech partners, and consider areas of their organizations that could benefit from AI, freeing their teams to deliver more value to their customers.